In March, the electricity consumption of the whole society increased by 4.8% year-on-year

CCTV News: In the first quarter, China's economy grew by 5.4% year-on-year, higher than the expectations of many international investment banks and financial institutions. Many well-known international investment institutions believe that as the US tariff policy disturbs the global trade pattern and drags down the world economic recovery, China is more prepared and the core position of China's global industrial chain is irreplaceable. It is expected that China's economy will maintain steady growth in 2025. Invesco: External risks rise and China's economy performs well

Invesco, an investment in Atlanta-based city in the United States, believes that in the first quarter of 2025, China's major economic indicators rebounded and improved, among which the export and industrial manufacturing sectors performed particularly strongly.

Zhao Yaoting, global market strategist at Invesco Asia-Pacific (except Japan), said that China's exports and industrial manufacturing were strong in the first quarter, and infrastructure investment also performed stably. The most important economic sector may be consumption. From the perspective of retail sales, consumption is stabilizing. Overall, even if external downward risks rise, 2025 will be a year for China's economy to perform well. Barclays Bank: The fiscal stimulus effect is significant, and China's consumption continues to improve.

In response to the rapid growth trend of China's service consumption in the first quarter, Barclays Bank said it is optimistic about the effect of China's increase in consumption package, and it is expected that consumption will contribute more momentum to overall economic growth.

Chang Jian, chief economist at Barclays Bank, said that China's consumption part in the first quarter was particularly impressive, exceeding their expectations, and both data and front-line feedback were exciting. The government's "old for new" policy has provided a substantial boost to retail sales. Morgan Stanley: China is irreplaceable in many key industries around the world

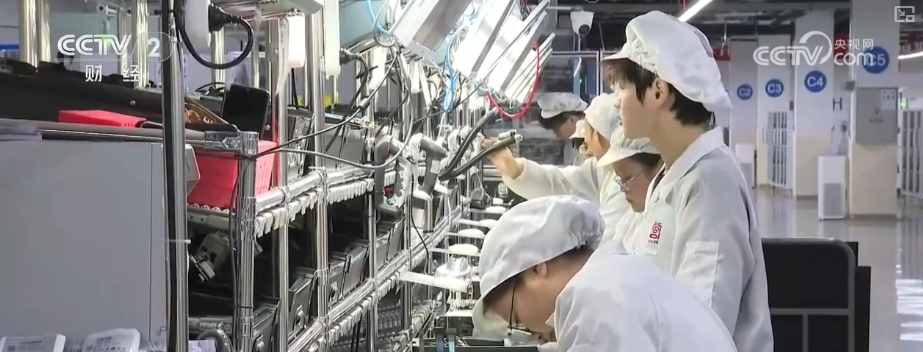

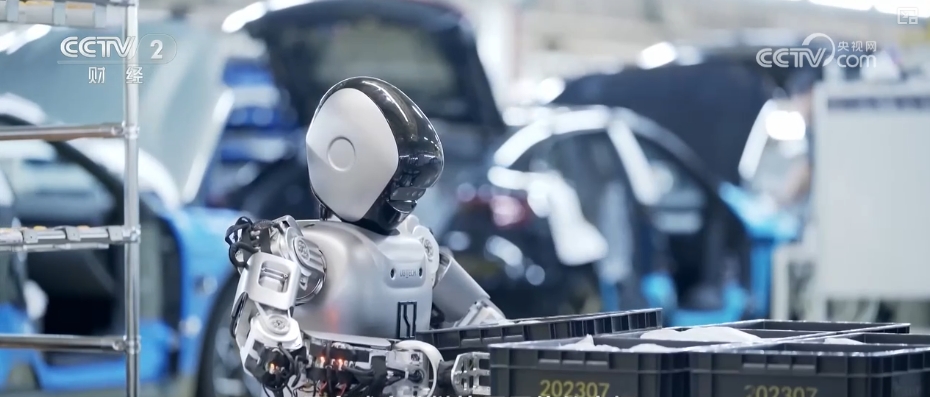

Morgan Stanley China chief economist Xing Ziqiang pointed out that China is the center of the global industrial chain collaborative network and is irreplaceable in many key industries, so it can better cope with the many uncertainties caused by US tariff policies.

Xing Ziqiang introduced that China now has irreplaceable advantages in many key industries around the world. For example, in the automotive parts industry, new energy equipment industry, power battery industry, and even high-end precision equipment, it is the center of the global industrial chain collaborative network. China's competitive advantage in the next stage of industrial revolution is irreplaceable.