CCTV News: Recently, it has been a intensive period for the release of annual reports of listed companies. Up to now, the 2024 annual reports of major banks and insurance companies listed on the A-share market have been released. Overall, the total assets of my country's banking and insurance industry have grown steadily, and the asset quality has continued to be optimized.

From the banking industry, the asset scale and net profit of the six major banks, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, Construction Bank, Bank of Communications, and Postal Savings Bank of China all maintained growth to varying degrees in 2024, and the six banks achieved a total net profit of more than 1.4 trillion yuan.

From the insurance industry's perspective, five insurance companies listed on the A-share market, including China Insurance, China Life Insurance, Ping An, Xinhua Insurance and China Taiping, achieved a total net profit of 346.882 billion yuan, a year-on-year increase of 77.7%, and an average daily profit of more than 900 million yuan, setting a record high. Insurance institutions expressed their long-term optimism about China's economic growth prospects.

Fund flow is one of the most important leading indicators for observing the economy. Some of the loans issued last year became raw materials for enterprises at that time, while others would "add strength" and "add color" to the real economy this year or even longer. So, what areas were the main investments in banks and insurance funds last year?

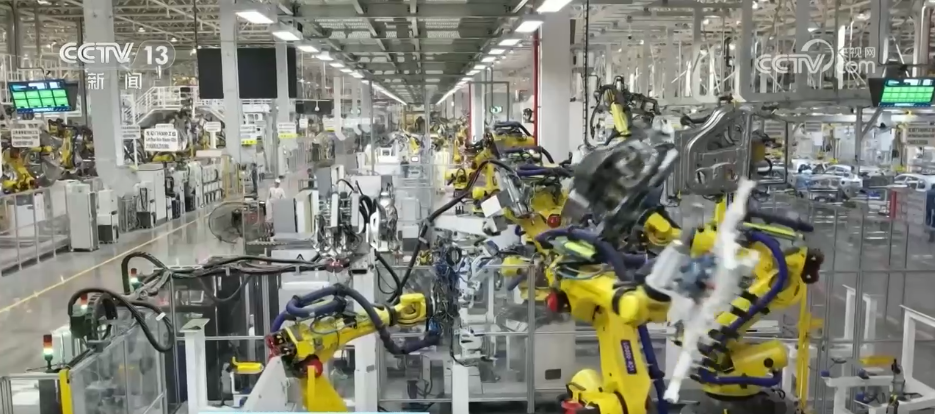

As of the end of 2024, the loan balances of the six major banks of Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, Construction Bank, Bank of Communications, and Postal Savings Bank of China totaled more than 117 trillion yuan, and the new loans issued throughout the year exceeded 9.6 trillion yuan. Various banks and insurance institutions have also increased their investment in technology, new quality productivity and other fields.

Banks have also increased financial support in promoting consumption, expanding domestic promotion, etc. As of the end of 2024, the balance of personal consumption loans of Bank of Communications increased by 90.44% compared with the end of the previous year; the balance of personal consumption loans of Agricultural Bank of China and China Construction Bank increased by more than 25% year-on-year. In addition, since the fourth quarter of last year, positive changes have occurred in the real estate market, which has also been confirmed by the bank credit aspect.

What areas will the funds focus on supporting this year?

This year, my country's monetary policy has changed from stable to moderately loose. Under the new policy environment, many banks and insurance institutions have stated that they will increase credit supply and provide stable, strong and sustainable financial support for the development of the real economy.

Bank of Communications said that in 2025, it plans to invest 480 billion yuan in corporate credit increments, and invest in key areas that conform to policy orientations such as major projects, manufacturing, rural revitalization, and strategic emerging industries. China Construction Bank said that in 2025, it will strengthen the financial supply of green credit in key areas such as energy, industry, and transportation.

As one of the main forces of long-term funds, many insurance companies also stated that this year they will focus on high-value-added fields such as new energy, robots, and artificial intelligence, as well as key areas related to the national economy and people's livelihood.

"Artificial intelligence" promotes the accelerated transformation of the banking and insurance industry

This year, "artificial intelligence" was talked about at the performance conferences of various banks and insurance institutions. So, how do these financial institutions use artificial intelligence to empower economic development?

The reporter used DeepSeek to analyze the content of the annual report conference of banks and insurance companies, among which "artificial intelligence" became a core topic. For example, Ping An of China mentioned 39 "artificial intelligence" at its performance conference. Various financial institutions have generally connected to DeepSeek.

With the empowerment of artificial intelligence, it not only allows financial institutions to provide more intelligent and personalized services, but also brings tangible benefits to consumers.

In 2024, the six major banks invested more than 120 billion yuan in financial technology, and various banks have widely used artificial intelligence in areas such as credit issuance, remote banking, AI customer service, and anti-money laundering and anti-fraud.