CCTV News: The State Administration of Taxation said that the 2024 personal income tax settlement will be held from March 1 to June 30, and appointments can be made from February 21. Who needs to apply for annual personal income tax reconciliation? How to handle it specifically?

The comprehensive income of last year was not more than 120,000 yuan, and there was no need to handle it

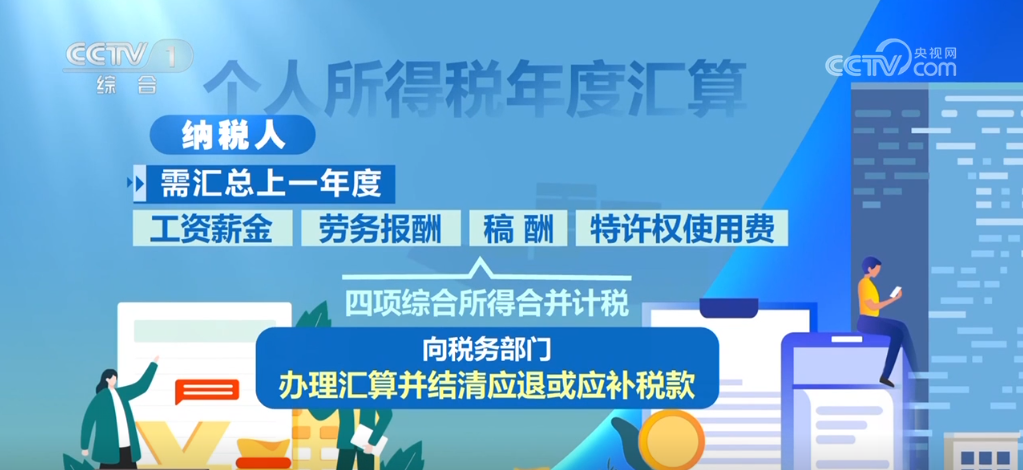

The annual reconciliation of personal income tax refers to the taxpayer who needs to summarize the previous year's wages and salaries, labor remuneration, royalties, and royalties to consolidate the taxes, and handle the reconciliation with the tax department and settle the refund or reimbursement of the tax.

Who needs to handle annual personal income tax reconciliation?

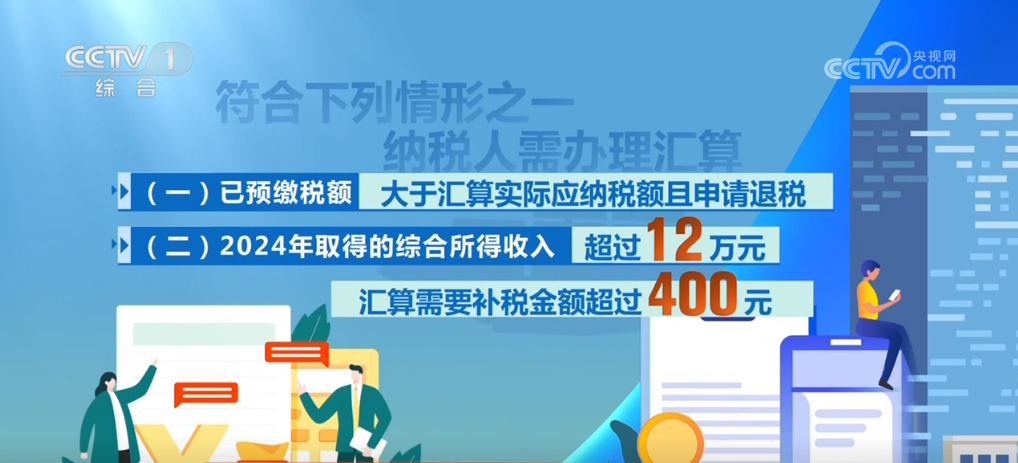

(I) If the tax amount paid is greater than the actual tax payable in the reconciliation and the tax refund is applied for;

(II) If the comprehensive income obtained in 2024 exceeds 120,000 yuan and the tax amount required for reconciliation exceeds 400 yuan.

If your comprehensive income does not exceed 120,000 yuan last year, or the annual taxes that should be supplemented do not exceed 400 yuan, no matter how much tax is displayed in the system, there is no need to settle the settlement.

Individual income tax reconciliation can be handled in three ways

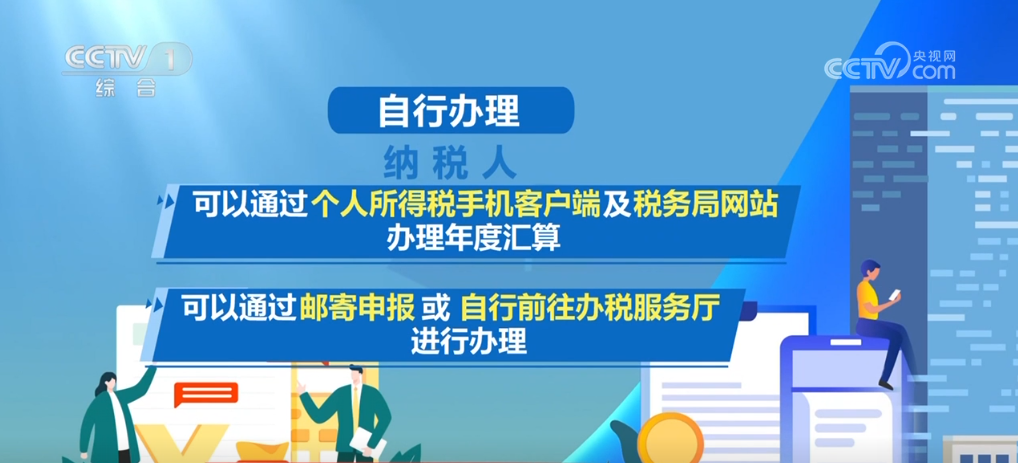

The comprehensive annual reconciliation of personal income tax can be handled in three ways: self-processing, through the employing unit, and entrust the trustee to handle it.

If you handle it yourself, the taxpayer can handle the annual reconciliation through the personal income tax mobile client and the tax bureau website, or you can file a declaration by mail or go to the tax service hall by yourself. If the handling is carried out by the employing unit, the taxpayer must submit an agency request to the unit. The unit shall handle the handling, or train or instruct the taxpayer to complete the settlement declaration, refund and tax reimbursement. If the trustee entrusts the processing, the taxpayer must sign a letter of authorization with the trustee. After the unit or trustee handles the reconciliation for the taxpayer, it shall promptly inform the taxpayer of the handling situation.

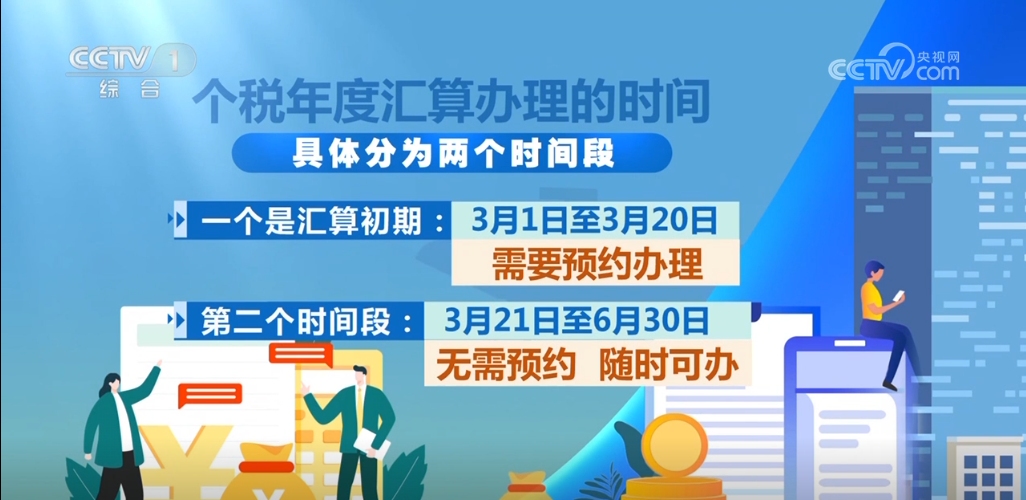

The annual reconciliation time for personal income tax is divided into two time periods

The annual reconciliation time for personal income tax is divided into two time periods. One is the early stage of reconciliation: from March 1 to March 20, this time period requires an appointment; the second time period is from March 21 to June 30, which taxpayers do not need to make an appointment and can handle it at any time.