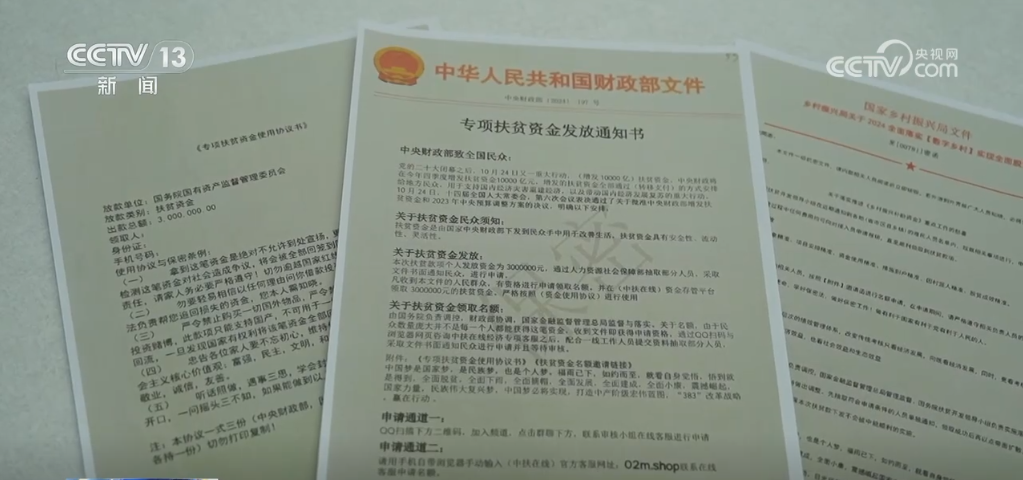

CCTV News: Recently, Aunt Wu, who lives in Dafeng District, Yancheng, Jiangsu Province, received a strange express document containing a "Notice of Issuance of Special Poverty Alleviation Funds". The notice claimed that Aunt Wu could receive up to 3 million yuan of "digital rural poverty alleviation funds." However, she unknowingly got into the trap of fraudsters.

The unprepared Aunt Wu joined a group chat through the QR code on the file. In this group, many group members claimed that they had received poverty alleviation funds, and three enthusiastic "customer service" staff provided guidance to her who had just joined the group. Because I kept seeing the group members in the group receiving poverty alleviation funds, Aunt Wu completely lost her ability to distinguish. She did everything she asked for the "customer service" staff.

The client Aunt Wu said that the customer service asked for her mobile phone number, bank card number, ID number, and personal information. He had to verify his identity and call her the money. Aunt Wu didn't think much about it, and later sent the information to the scam.

The police said that the fraudsters used these false "group friends" and "customer service" to create a real and credible atmosphere, which made Aunt Wu gradually relax her vigilance.

Transfer in first and then transfer out. The victim's withdrawal caused the bank to be alerted

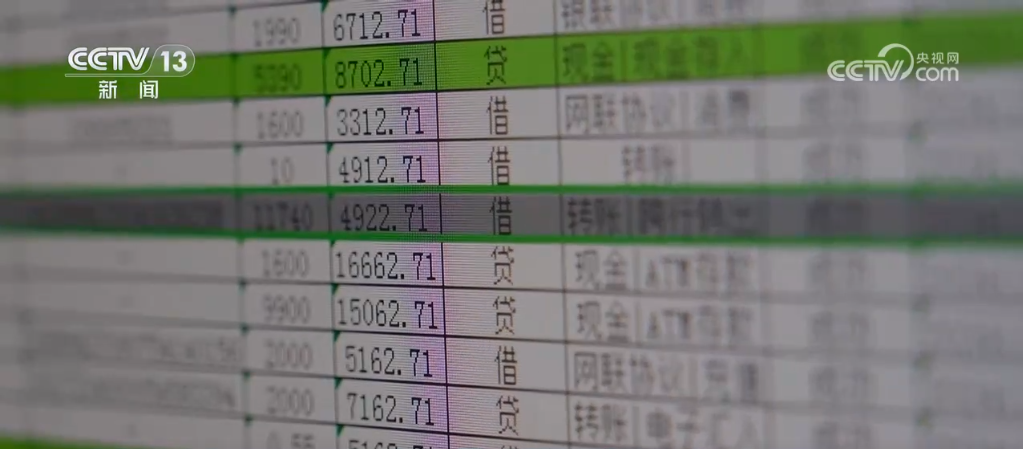

Aunt Wu joined the group chat and was about to leave his personal information. This was just the beginning of the fraud. Next, the fraudsters first transferred a 30,000 yuan amount of funds to Aunt Wu's account on the grounds of "packaging flow" and "loyalty testing", and then guided Aunt Wu to withdraw the money from her bank account and transfer it to the account designated by the fraudster. However, when Aunt Wu followed the other party's instructions to get money, it aroused the alertness of the bank staff, and the bank decisively contacted the public security organs.

After receiving the alarm, the local police quickly verified the remittance clues of the money and confirmed that the 30,000 yuan fund was actually the fraudulent funds of another victim of the fraud. Subsequently, the police officer in charge of the case contacted the victim Li, and after explaining the situation to her, he returned all 30,000 yuan to Li's account.

The police officer in charge of the case said that the core of this case was not to directly cheat Aunt Wu’s money, but to transfer money to Aunt Wu’s account, so the victim felt that there was definitely no risk. In fact, the real purpose of the fraudster is to ask Aunt Wu to help transfer the funds she defrauded, which is essentially money laundering. Aunt Wu unknowingly became their accomplice and a tool for telecommunications fraud.

In accordance with the relevant provisions of the "Anti-Telecommunication Network Fraud Law of the People's Republic of China", illegal lending of telephone cards, bank cards, etc. for others to use will be held legally responsible. In this case, Aunt Wu's behavior of lending a bank card to others was fortunately stopped in time and helped the police recover the victim's losses in a timely manner, and the police did not punish her.

Police reminds: There are formal channels and processes for national welfare policies

Scammers are pervasive and have many tricks. How should the people prevent them? Let’s see the police’s reminder.

First of all, it should be clear that all kinds of welfare policies in the country have formal application channels and procedures. These policies will not be notified and received through unofficial channels. Therefore, any notice that claims to receive high benefits or rewards should be kept calm, carefully verify the authenticity, and do not easily believe the information of strangers.

The police remind that when downloading and using financial apps, you also need to act cautiously, be sure to choose formal channels, and carefully check the app's qualifications and related information.

The police reminded that the review of financial apps on the mobile application market is very strict and relevant qualification certificates are required. Since false apps cannot be listed on the formal application market, scams usually trick victims into downloading by sending URL links or QR codes. These fake apps often hide malware and can steal users' personal information about citizens.

In addition, citizens need to legally use bank cards and telephone cards. These cards are an important guarantee for the security of personal property and information. Do not rent, lend or sell them to others at will. Once these cards are used by criminals, they may become tools for them to commit fraud. At the same time, everyone should also keep their personal information and account password properly to avoid using or leaking to strangers in an unsafe environment.